Zambia’s “lack of fiscal flexibility” will greatly affect its long-term ability to recover from a COVID-19-induced economic fallout, according to new data from the Africa Risk-Reward Index, compiled by Control Risks, the renowned global risk consultancy.

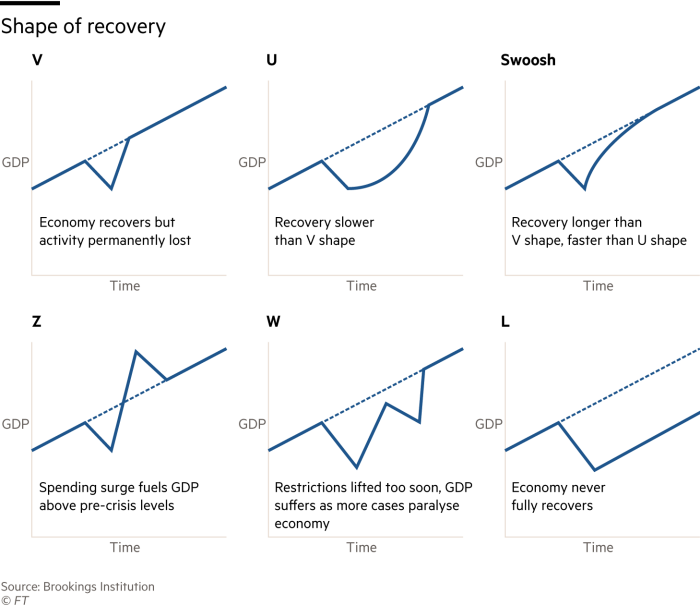

The more “fiscal space” (i.e. ability to disperse funds) that a country has, the faster its economy can recover. As the graph below shows, Zambia is on track to experience an agonisingly slow L-shaped recovery. Data from Control Risks, Oxford Economics, and Haver Analytics used countries’ Gross Domestic Product to deduce so-called “breathing space” within the national fiscus for implementing the support measures necessary to enable an economic recovery, post-COVID.

How fiscal space impacts recovery time

Looking at the continent as a whole, Control Risks notes that — with the exception of Botswana, Egypt, Mauritius, Morocco and South Africa, which have the fiscal headroom to engage in meaningful stimulus spending — “post-pandemic growth will have to be led by an already weak private sector, diminished further by the failure of companies left unsupported during lockdowns. The role of external support is essential here; private investors play a critical role in helping their portfolio companies access finance and markets…”

To attain the V-shaped growth rebound that would represent a relatively swift economic recovery, Zambia needs private sector investment. However, Zambia currently sits at the very bottom of a list of 26 African countries in the Africa Risk-Reward Index, a respected annual survey that charts the risks and rewards each country on the continent offers prospective investors. We must become a more attractive destination for capital, and soon.

There are some glaring wins that could be achieved too. According to the Chamber of Mines, Zambian mining companies are currently waiting for the green light on three major mining sector projects, among them $1 billion expansions by both Kansanshi Mining and Lubambe Copper Mines. The Chamber has indicated that the removal of the unorthodox policy on mineral royalties, amounting to double taxation, is all that is standing in their way.

See also: Risks and rewards: What does Zambia have to offer?