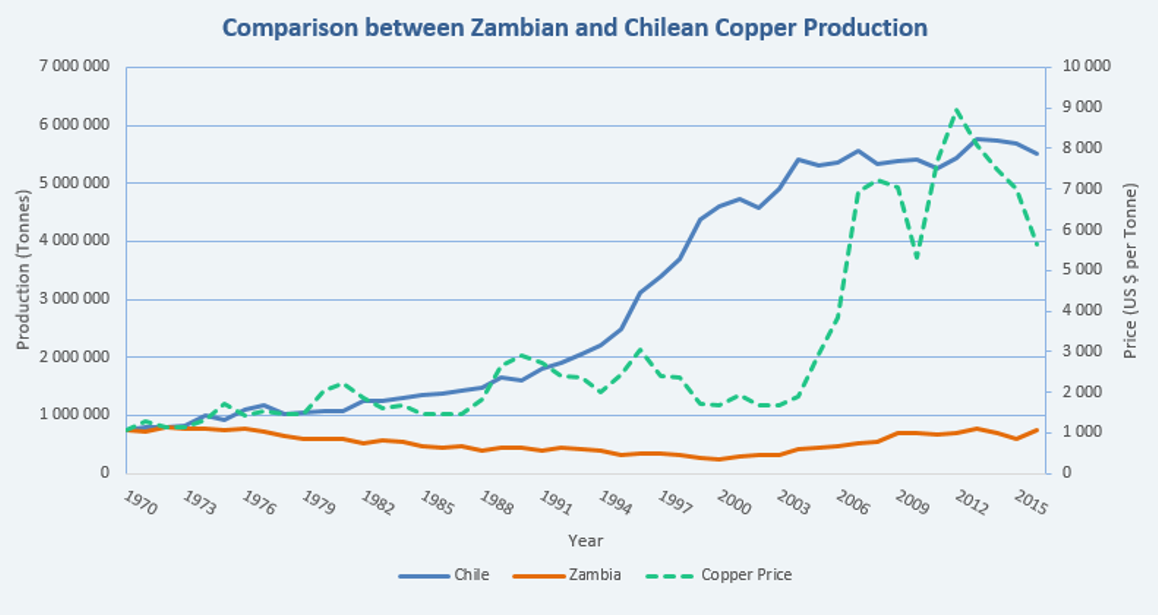

There is a myth that many people believe with regard to copper mining – that the price of copper alone determines the strength and success of the industry, as evidenced by the amount of copper produced.

Whilst price is a factor in any business, this graph clearly shows that it is the investment environment in which mining companies operate that really determines whether and where mines will be built, and how much they produce.

Chile is the world’s largest copper producer; in 1970, Zambia and Chile were producing the same levels of copper. Their paths have diverged in the intervening years, particularly during the 1990s.

Did Chile’s spectacular growth in production levels have anything to do with the copper price?

The plain answer is no. The production of copper by Chilean mining companies was on a steady upward trend, with a sharp increase in the 1990s, despite the copper price remaining low, and only increasing from 2003-2004. Furthermore, Chilean copper production remained steady despite a crash in the copper price in 2006, and did not increase markedly despite a significant subsequent recovery in the metal’s price.

So, why did Chile’s industry grow so spectacularly?

Why did Chile’s industry grow so spectacularly? Simple – the country’s investment policy environment changed.

Simple – the country’s investment policy environment changed. In 1988, Chile began its transition to democracy, and market friendly economics. This saw an increase in institutional stability, as well as guarantees for foreign investors. Further impetus was the implementation of Decree Law 600, which was ratified in 1993. This decree gave foreign investors guarantees and investment incentives – and it was in force for 22 years.

During the 1990s, private sector investment far outstripped that of the government in Chile’s copper industry, creating the industry that is there today. By comparison, Government investment only surged when the price moved in 2003-2004.