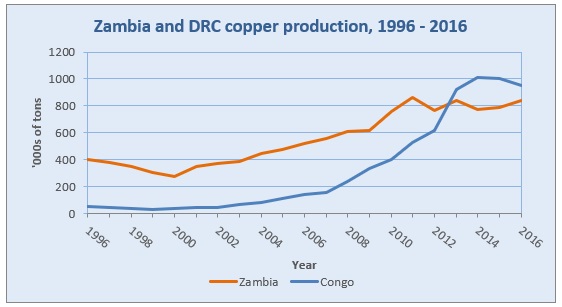

In 2013, for the very first time, the Democratic Republic of Congo (DRC) overtook Zambia to become Africa’s leading copper producer, with an output of 925 000 tonnes. This is an extraordinary accomplishment, given that barely 10 years earlier, the country was producing a mere 70 000 tonnes annually.

As the graph shows, the DRC came off a low base and rapidly increased its copper production, eventually catching up with Zambia in 2013 and overtaking it a few years later, hitting a record 1 million tonnes. What accounts for this amazing growth surge?

There are a number of explanations for this extraordinary expansion.

The country is now relatively stable, following a long period of war and conflict. In 2003, the devastating wars that had paralysed the country after the autocratic rule of President Mobutu Sese Seko ended in 1997, ended. The conclusion of these conflicts – which had begun in 1996 in an attempt to overthrow Mobutu and resulted in at least 4-million deaths – allowed the economy to stabilise and for investors to once again to return to the country.

The average mineral grade of copper in the DRC is also fairly high, making it a mining destination of choice for many investors. Most copper mines in the DRC are estimated to have an average ore grade of over three percent, far higher than the global average of between 0.6% and 0.8%. For example, the Tenke Fungurume copper mine – the biggest mine in the DRC in 2016 – has an average ore grade of 2.6% as compared to a global average of 0.8%.

The country is now relatively stable, following a long period of war and conflict

An equally important contributing factor was the implementation of an investor-friendly mining code that had been enacted in 2002, under the auspices of the World Bank. The code featured a fairly low tax rate of 30% on profits, a government stake of 5% in new mining projects, and royalties of 2% on copper and cobalt. This opened up the mining industry to considerable foreign investment and new mine development, despite political instability in the region and the continuous threat of conflict.

Furthermore, the DRC’s production costs are extremely favourable compared to regional competitors. In 2013 the average production cost of copper in the DRC was $3,672 per tonne. This same cost was $4,582 in Zambia and $4,931 in South Africa. This contributes it to being a favoured mining destination in the region.

However, investor uncertainty around mining policy has been increasing in recent years. The government is considering increasing profit tax from 30% to 35%, mineral royalties from 2% to 3.5%, and taking its stake in new mining ventures from 5% to 10%.

Although the country is fairly stable and peaceful (by its historical standards) there are still risks. Katanga – the province where many of the DRC’s mining assets are to be found – has a long history of secessionist ambitions and conflict with the central government in Kinshasa. Another risk is that elections in the country have been postponed. Presidential elections were scheduled for this month, with the President, Joseph Kabila, expected to stand down next month, as he is constitutionally barred from running for another term. However, the elections have been postponed to April next year, despite anger from opposition parties, which may further increase the risk of operating in the country.

It is clear that the reasons for the increase in the DRC’s levels of copper production are complex. A number of factors have led to the large increases in production, and these include a fairly stable policy and security environment, but are also linked to the high grades of copper ore that can be found in the country. Countries cannot do much about the grade of ore that is available to mine, but they can make sure that mining policy is fair and stable, and that the risk of conflict is low, allowing investors an enabling environment in which to mine.

See also: Behind Chile’s copper boom