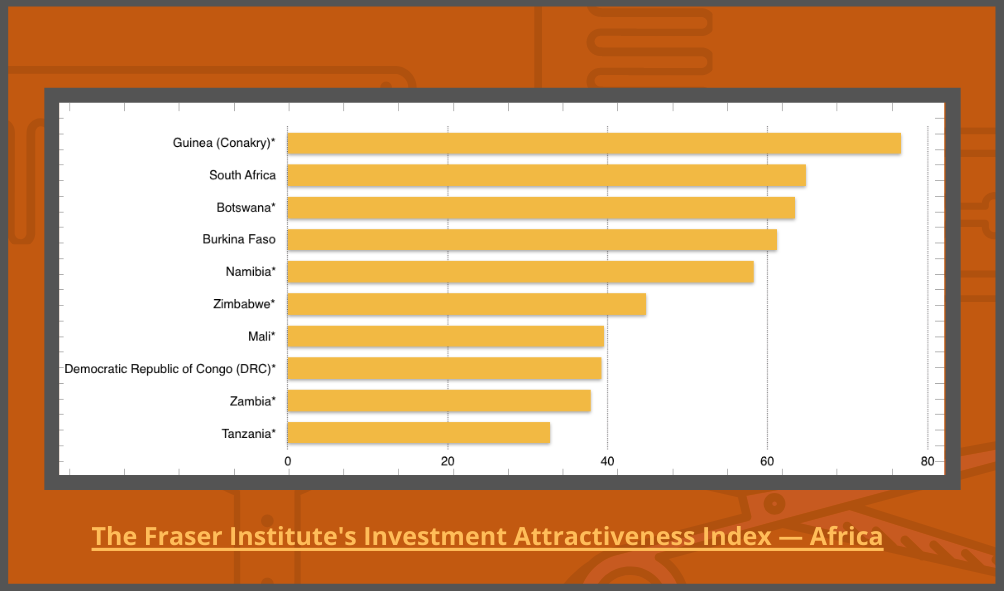

Zambia is one of the ten least attractive jurisdictions in the world for mining investment, according to the Annual Survey of Mining Companies, released this week by the Fraser Institute, an independent think-tank, and the global benchmark for investors’ perceptions.

“The mining survey is the most comprehensive report on government policies that either attract or discourage mining investors,” said Ashley Stedman, co-author of the report and senior policy analyst at the Fraser Institute. The annual survey is closely watched by companies, minerals councils and mining chambers, as well as minerals and mining ministries, which typically use the results as a measure of their efficacy in attracting investment. Zambia has been evaluated in the survey for several consecutive years, but this was the first time that it was ranked in the bottom ten of the participating jurisdictions.

The Fraser Institute sent the survey to a total of 2,400 respondents in order to assess how mineral endowments and public policy factors including taxation and regulatory uncertainty affect exploration investment and, in 2019, received enough responses to evaluate 76 jurisdictions. The institute takes into account regions’ geological attractiveness, mineral potential and policy perception (using the Policy Perception Index) and combines these to construct its Investment Attractiveness Index.

This year, Zambia was ranked in the bottom ten for both the Investment Attractiveness Index and the Policy Perception Index. It stood two places below the Democratic Republic of Congo (DRC) among the “least attractive jurisdictions for mining investment”, in position 71 out of 76 regions surveyed. But this was not always the case.

Zambia’s ratings declined sharply

A table displaying Zambia’s previous rankings and scores in the Investment Attractiveness Index show that Zambia’s standing dropped drastically in 2019 compared to 2018, 2017, 2016 and 2015. Whereas the country was given a score of 63.60 for investment attractiveness in 2018, this dropped to 37.90 in 2019. The decline in Zambia’s Policy Perception Index score was equally sharp, from 65.25 in 2018 to 38.50 in 2019.

A major deterioration of how the outside world perceives a country as a mining investment destination requires further substantiation and, accordingly, the factors that influence rankings are part of the Fraser Institute’s annual survey. Whereas in Tanzania, the most significant drop in points (within the Policy Perception Index) was attributed to growing concern about the availability of labour and skills, survey respondents did not perceive there to be similar challenges in Zambia. This year, respondents on Zambia expressed increased concern over “regulatory inconsistencies”, the soundness of the geological database, and security.

Zambia joined Tanzania and Zimbabwe at the bottom, among the countries experiencing drastic declines in their Policy Perception Index rankings. In contrast, neighbouring Botswana and Namibia scored 83.48 and 87.22 respectively (compared to Zambia’s 38.50) based on the same metrics.

Each jurisdiction’s taxation regime was also measured, and this proved to be another area in which Zambia fell short. Respondents quantified how likely they were to invest in a jurisdiction based on its taxation regime (including personal, corporate, payroll, capital, and other taxes, and complexity of tax compliance). One quarter of respondents said that they would not pursue investment in Zambia’s mining sector due to its taxation regime, one quarter said that this factor was “a strong deterrent to investment’, one quarter said it was a “mild deterrent to investment”, and one quarter said it was “not a deterrent to investment”.

Zambia joined Tanzania and Zimbabwe at the bottom, among the countries experiencing drastic declines in their Policy Perception Index rankings.

Notably, 0% of respondents felt that Zambia’s taxation regime “encourages investment.” In comparison, 50% of respondents said that Botswana’s taxation regime does. “A sound regulatory regime coupled with competitive taxes are key to making a jurisdiction attractive to investors,” said co-author of the report, Ashley Stedman.

A survey of this depth is invaluable to prospective and current investors in the world’s mining sector. When 76 jurisdictions (many with a similarly rich mineral endowment) are all laid bare beside one another, predicting the direction of future investment flows ceases to be a guessing game.

See also: Zambia drops out of top 50 global mining jurisdictions